texas estate tax exemption

As a result the estate tax rate is 40 and Doras estate is worth 17 million. Texas Property Tax Code.

There is no state property taxProperty tax brings in the most money of all taxes available to local governments to pay for schools roads police and firemen emergency response services libraries parks and other services provided by local governments.

. Jefferson Central Appraisal District. Download PDF 101KB Filed Under. Failure to receive a tax statement does not affect the validity of the tax penalty interest due date the existence of a tax lien or any procedure instituted to collect a tax Sec3101 g Texas Property Tax Code.

However exempt organizations are required to collect tax on most of their sales of taxable items. For instance you pay taxes on your house even if it was worth just 80000 because your home is worth 100000 and you are eligible for a deduction of 20000. Phils unused 1145 million estate tax exemption would be added to Doras exemption of the same amount with portability.

Mineral utility and industrial accounts are appraised for the district by Capitol Appraisal Group Inc. The tax is based upon the entitys margin and can be calculated in a number of different ways. Property taxes are the major source of revenue and bring in most of the money to provide services offered by the local government.

Texas law also provides. Each business in Texas must file an Annual Franchise Tax Report by May 15 each year. Lets assume that the federal estate tax exemption is still 1164 million when Dora later passes away.

While Texas REALTORS has used reasonable efforts in collecting and preparing materials included here due to the rapidly changing nature of the real estate marketplace and the law and our reliance on information provided by outside sources Texas REALTORS makes no representation warranty or guarantee of the accuracy or reliability of any information provided. If you have not received a tax statement by November 1 please contact our office at 972-547-5020. Homestead exemption Texas refers to the deduction from the house that allows you to save money on your propertyThe exception excludes half of your propertys worth from taxation and reduces your taxes.

Texas Dept of Housing and Community Affairs. Collin County Tax Assessor-Collector Tax Rates. The Texas Franchise Tax is levied annually by the Texas Comptroller on all taxable entities doing business in the state.

An individual who is eligible. Property tax in Texas is a locally assessed and locally administered tax. Tax Rates Tax Rate History.

Real estate and personal property accounts are appraised locally by the district. This gives Dora a 2467. G If the residence homestead exemption provided by Subsection d of this section is adopted by a county that levies a tax for the county purposes authorized by Article VIII Section 1-a of the Texas Constitution the residence homestead exemptions provided by Subsections a and d of this section may not be aggregated for the county tax purposes.

Tax Rate Calculation Worksheets. Our Texas real estate exam prep has helped thousands of test-takers pass their real estate exam and comes with over 500 practice real estate exam questions and 450 vocabulary test questions with detailed answer explanations. Comptroller of Public Accounts.

A homestead exemption is a benefit to homeowners allowing for the removal of a portion of the homes value from taxation which in turn lowers the property taxes owed each year. As you may already know Texas does not have a state property tax the property tax rates are locally assessed. The Hazlewood Act is a State of Texas benefit that provides qualified Veterans spouses and dependent children with an education benefit of up to 150 hours of tuition exemption including most fee charges at public institutions of higher education in TexasThis does NOT include living expenses books or supply fees.

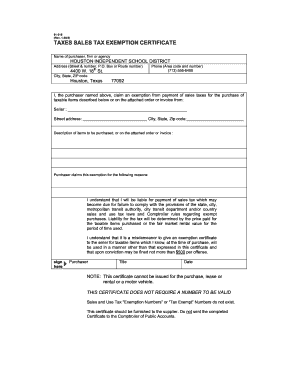

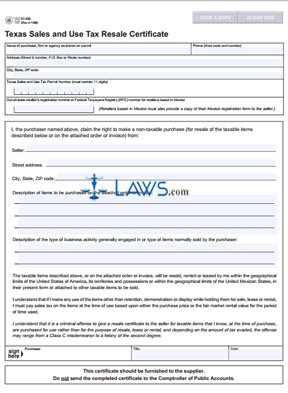

Texas tax law provides an exemption from sales tax on goods and services purchased for use by organizations exempt under Section 501c3 4 8 10 or 19 Internal Revenue Code IRC. The Texas government offers special protections for the property owners in Texas and one such protection is the over 65 exemption. With our program your real estate practice test results are broken down by topic solidifying your understanding of the material.

Jefferson County Texas Website. See Exempt Organizations Sales and Purchases Publication 96-122. If you purchased a home in 2020 get ready to file your Homestead Exemption Application.

Tax Rate Entity Summary Truth in Taxation Summary. Jefferson County Tax Rates. Who Must Pay the Franchise Tax.

You may save thousands each year by applying for an exemption so dont let the opportunity pass you by. Tax rates and ultimately the amount of taxes levied on property are determined by governing bodies of each of the taxing authorities.

Sales Tax Exemption Form Texas Fill Out And Sign Printable Pdf Template Signnow

Texas Homestead Tax Exemption Cedar Park Texas Living

Texas Estate Tax Everything You Need To Know Smartasset

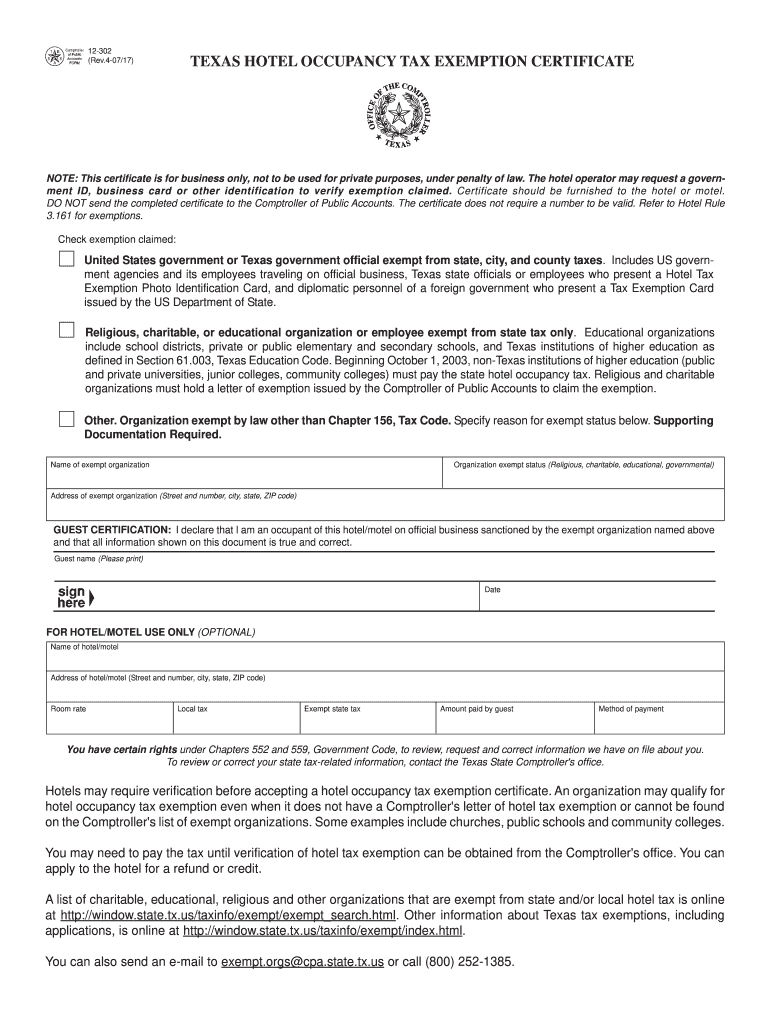

Form 12 302 Fillable Texas Hotel Occupancy Tax Exemption Certificate Fill And Sign Printable Template Online Us Legal Forms

Texas Estate Tax Everything You Need To Know Smartasset

Free Form 01 339 Texas Sales And Use Tax Exemption Certification Free Legal Forms Laws Com

Texas Estate Tax Everything You Need To Know Smartasset

Texas Homestead Application O Connor Property Tax Reduction Experts